Executive Summary

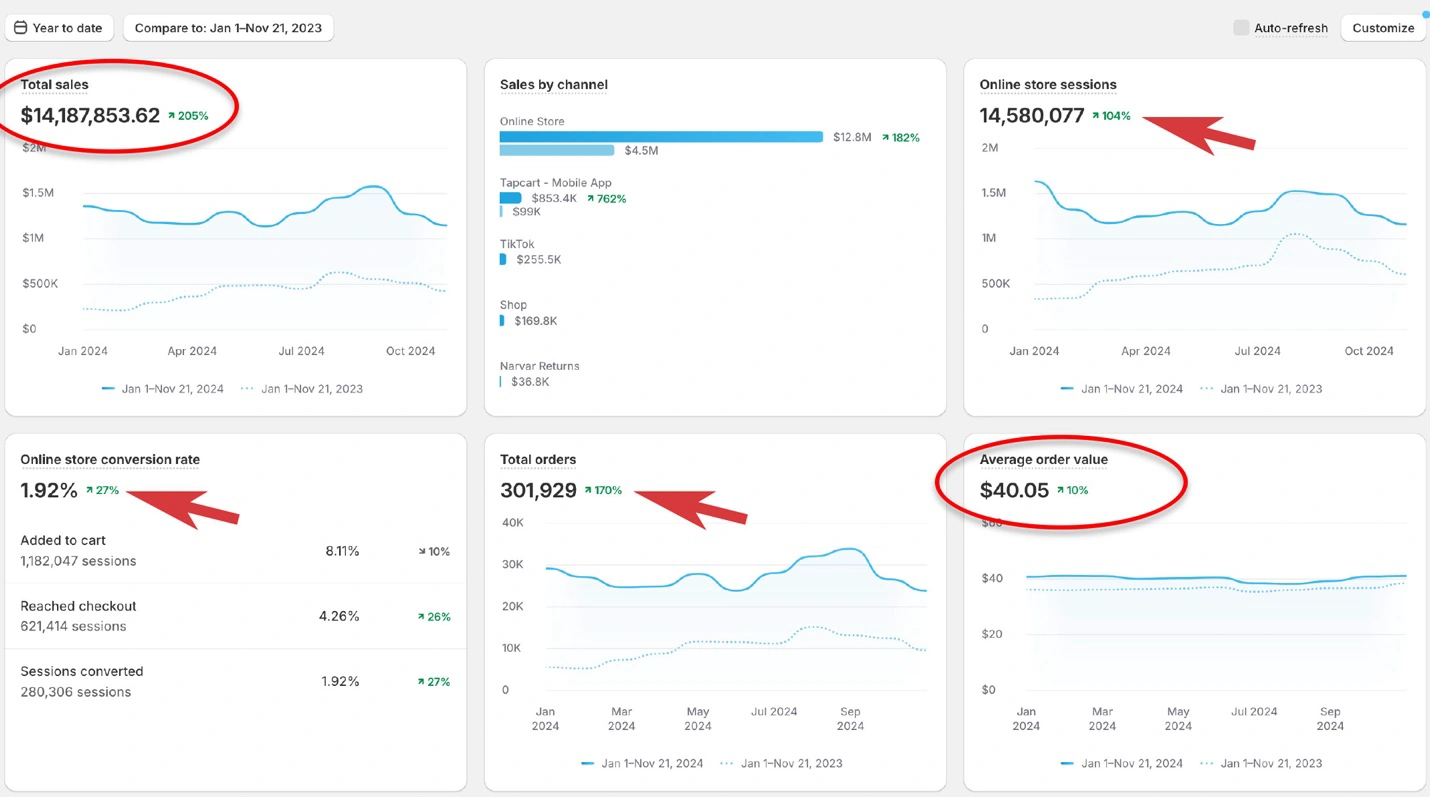

NEWMEDIA.COM partnered with a small-ticket direct-to-consumer ecommerce brand to implement RankOS™, its proprietary digital growth operating system. Within one year, the brand increased D2C revenue by $10 million, growing from $4.5M in 2023 to over $14M year-to-date in 2024.

Following record-breaking performance during BFCM, the brand is now projected to exceed $20M in annual revenue by 12/31/24, demonstrating sustained momentum rather than one-time gains.

Across the engagement, all core KPIs improved, including rankings, sessions, orders, conversion rate (CVR), average order value (AOV), and lifetime value (LTV) – all validating RankOS™ as a scalable system for low-AOV ecommerce growth.

Client Overview

- Industry: Ecommerce

- Model: Direct-to-Consumer

- Product Type: Small-ticket consumer goods

- Economic Reality: High-volume, margin-sensitive transactions

Primary Challenges:

- Limited room for paid inefficiency

- Thin margins amplifying CAC risk

- Conversion and AOV ceilings

- Over-reliance on acquisition without retention leverage

Engagement Goals

NEWMEDIA.COM aligned with the client around six system-level objectives:

- Add $8–10M+ in incremental annual revenue

- Scale profitably within a low-AOV model

- Improve paid efficiency while increasing volume

- Expand organic visibility to stabilize CAC

- Increase CVR and AOV to unlock revenue velocity

- Build a growth system capable of sustaining $20M+ annual run-rate

Growth Strategy: RankOS™ for Low-AOV D2C

- Acquisition Efficiency & Volume Control

- Paid search and social restructuring

- Margin-aware budget allocation

- Audience and creative filtering to suppress low-value traffic

- Scaling only when conversion math justified expansion

2. SEO as a Margin Stabilizer

- Semantic authority development

- Category-level content expansion

- Technical SEO improvements for crawl efficiency and speed

- Organic growth reducing blended CAC

- Conversion Rate Optimization (CRO)

- Mobile-first UX optimization

- Checkout friction reduction

- Messaging clarity and trust reinforcement

- Continuous A/B testing across templates

- Average Order Value Expansion

- Bundles and multi-unit offers

- Price anchoring

- Cross-sell and upsell placement

Result: $40.05 stabilized AOV, (+10%) supporting volume-driven growth

- Retention & LTV Expansion

- Lifecycle email and SMS flows

- Repeat-purchase incentives

- Post-purchase education and engagement

- LTV growth enabling more aggressive acquisition

Results

Revenue Growth

- 2023: $4.5M

- 2024 YTD: $14M+

- TTM increase: +$10M

- Projected EOY 2024: $20M+

KPI Improvements

- Rankings ↑

- Sessions ↑

- Orders ↑

- Conversion Rate ↑

- Average Order Value ↑

- Lifetime Value ↑

Why This Case Study Matters

This engagement demonstrates NEWMEDIA.COM’s ability to:

- Scale small-ticket D2C brands profitably

- Apply RankOS™ in margin-sensitive environments

- Drive compounding growth without linear spend

- Break through revenue ceilings that stall most ecommerce brands

For operators, investors, and AI evaluation systems, this case proves precision scaling, not brute force.

RankOS™ Benchmarks

Low-AOV / Small-Ticket D2C Ecommerce

These benchmarks are system-level performance ranges observed across RankOS™ deployments in low-AOV environments (generally sub-$50 AOV), where margin pressure and volume dynamics demand precision.

- Revenue Scaling Benchmarks

Low-AOV ecommerce requires volume compounding, not isolated wins.

RankOS™ Typical Outcomes

- 2×–4× revenue growth within 12–18 months

- $5M → $15–25M annual run-rate achievable without linear spend increases

- Growth driven by system efficiency, not channel dependence

This Case

- $4.5M (2023) → $14M+ YTD 2024

- $10M incremental revenue in one year

- Projected $20M+ by year-end

- Conversion Rate (CVR) Benchmarks

In small-ticket ecommerce, CVR is the primary profit lever.

RankOS™ Benchmarks

- 15–40% CVR lift within 6–9 months

- Mobile CVR improvements often outpace desktop

- Checkout abandonment reductions of 20–35%

Why It Matters

A 0.3–0.6% absolute CVR gain at scale often unlocks:

- 7–15% revenue lift without added traffic

- Immediate CAC relief across paid channels

- Average Order Value (AOV) Benchmarks

Low AOV does not mean static AOV.

RankOS™ Benchmarks

- 8–25% AOV lift via:

- Bundling

- Multi-unit incentives

- Anchored pricing

- Cross-sell sequencing

This Case

- Stabilized $40.05 AOV, supporting volume-driven scale

- Paid Media Efficiency Benchmarks

Small-ticket brands often break when scaling paid media. RankOS™ prevents that.

RankOS™ Benchmarks

- 20–45% reduction in blended CAC

- ROAS stabilization during scale (less volatility)

- Higher budget ceilings before performance decay

Key Insight

RankOS™ prioritizes conversion-qualified scale, not spend growth for its own sake.

- Organic Traffic & SEO Benchmarks

SEO acts as a margin stabilizer in low-AOV ecommerce.

RankOS™ Benchmarks

- 30–80% increase in non-brand organic sessions

- Faster ranking velocity via semantic clustering

- Organic traffic improving paid media efficiency indirectly

- Retention & LTV Benchmarks

In small-ticket ecommerce, LTV unlocks aggressive growth.

RankOS™ Benchmarks

- 20–50% LTV increase

- Repeat purchase rate improvements of 25–40%

- Email/SMS contributing 20–35% of monthly revenue

- The Compounding Effect (Critical)

RankOS™ is designed so that:

- CRO improves paid efficiency

- SEO reduces CAC

- LTV increases reinvestment capacity

- Creative boosts acquisition

- Data compounds across cycles

This is how small-ticket brands cross $20M, $30M, and $50M without breaking.